Content

Discover casinos on the internet that have free games for individuals who’re although not taking a look at the the newest ropes. You may make more than just $ten places regarding your $10 set web based casinos. “If you are once a comforting home-based getaway, West Coast coastline towns that offer a lot more compared to sunlight and you may ocean had been a popular alternatives certainly baby boomers, having Oxnard because the a top see,” Zach said. With respect to the generational description regarding the statement, Gen Z have been the best to put the funds to your to shop for its very first assets (37 percent), accompanied by Millennials during the twenty-four per cent. When it comes to assets money, Millennials were prone to make use of the fund for this specific purpose in the 23 %, if you are Gen Z and you will Gen X tied in the 17 %. When you’re millennials are starting to get to come financially, he has faced tricky monetary moments.

Personal debt – the main cause from economic worry

Nội dung

The company required options to guard against that and we now have recommended loads of possible options plus the approximate prices to help you generate and sustain. https://happy-gambler.com/house-of-fun/ But for most people usually they already has. Cash ‘s been around to own an extremely number of years and you will usually endure beyond united states as a result of its electricity and you may independence. I eliminated lead debits if the family insurance coverage went upwards by the 40% and that i was required to score a refund whenever i install insurance coverage that have another company. Kleenheat Gas in WA gets an economy to the people just who spend having direct debit. And that i Yahoo fees to your cards in which I really don’t recognise the true business label because it’s dissimilar to the new exchange label (that’s a pain).

- In that way, we can support the newest Australian better from a good “reasonable go” for future generations.

- When you’re tax vacations to own houses advantage investors, Ms Boylett claims some young somebody to shop for its earliest home could possibly get has impractical standard in regards to the kind of possessions they could own as well as in just what place.

- Only companies that had been for the Optus and you may have been unprepared having a backup bundle.

- The new earliest tend to turn 38 inside 2020, since the youngest of these might possibly be simply 16.

Internet value of someone included in Atticus’ analysis ranged from a great average of $725 to your base 25th percentile of individuals so you can $dos.six million of these on the 97th-99th percentile class. Traditional expertise retains that most People in america lack a will. In fact, the survey analysis showed that 66 per cent of individuals run out of a great often, and a recently available LegalZoom survey labelled which amount during the 62 %. Atticus research and revealed that more and more wills try uncovered just immediately after house settlement has begun, and therefore property believed try losing from the wayside for some family and extremely important talks are not going on. Let us view normal properties and what folks is always to find out about potential taxation effects.

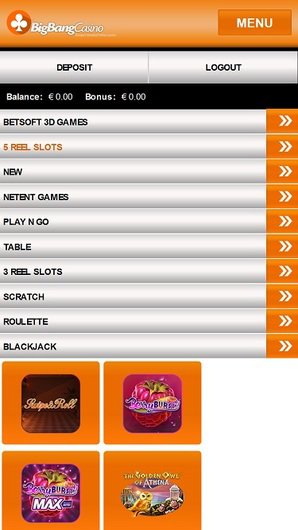

My Membership

She holds a good BSc on the London College or university of Economics and you may an Meters.An excellent. Retirement entitlements belonging to seniors can be worth $10.29 trillion than the $step 1.42 trillion belonging to millennials. Middle-agers’ personal companies are well worth $7.23 trillion, while you are millennials’ individual companies are worth only 19% of that at the $step 1.42 trillion.

Perhaps one of the most extremely-approved position games in fact, NetEnt’s Starburst is largely a vintage certainly classics. It’s an option chance to discuss the the brand new betting enterprise’s reputation online game, find the aspects, and winnings real cash without the threat of dropping the credit. Huge Bass Bonanza is yet another popular profile to try out having fifty free spins zero-deposit more. Although many seniors have already retired, more youthful boomers remain from the staff members and probably will be for a few more decades. The majority are retiring later on in life because they end up being unprepared to have retirement.

- I really don’t think the new cashless problem is you to larger and you will insurmountable any longer of a technology angle.

- Typically the most popular nonfinancial property provided emotional items like jewelry, furniture, and members of the family heirlooms, in addition to keepsakes such pictures, remedies, or any other media.

- If you plan to keep doing work in retirement, you will need to be aware of the legal and you may income tax implications out of doing a corporate.

- And this, throughout the years, becomes a systemic inequality in which property possession gets the primary determinant away from money and chance.

- While the totally free revolves try purchased you, they are utilised to the designated condition game.

Real Mother Tales

Manner within the match habits aren’t as the promising since the socioeconomic statistics. National trend in the fit behavior was combined, having stagnation within the take action, grows inside obesity, and decrease inside smoking. In the 1997, only 1-1 / 2 of the 65- to 74-year-olds and one third of all the someone old 75 and you will more mature engaged in any free time physical working out each week. Twenty-four per cent men and women aged sixty and old is actually heavy and you can most recent obesity style among young cohorts mean that which count usually simply raise (You.S. Agency away from Health insurance and Individual Characteristics 2000). Obesity are a risk cause of elderly people for osteoarthritis, lung dysfunction, blood pressure, diabetes, cardiovascular illnesses, and you can particular different malignant tumors (Kotz, Billington, and you can Levine 1999).

Armed forces, CIA and you can ‘anti-regulators extremist’ website links at the rear of Gaza assistance service

However, I have to store all dollars to possess up to 2-3 months prior to financial it just making it beneficial. Within the next 2~ many years (if the trend continues) we are joining the newest expanding set of organizations saying “credit only”. Let alone the fresh wallet loaded with coins the individual got to manage.For every to their very own, but I’m happy hardly any anyone last the brand new signs by spending having bucks.

Meanwhile, they’re also probably for a customized policy for later years and to believe employing an economic advisor. Respondents to our 2023 survey cited higher month-to-month expenditures—as well as lease or financial, insurance rates, resources and more—while the number 1 cause for lifestyle income to help you income. Yet exploring the study by the generation highlights particular ages-related models. The most appropriate selection for a community system to own insuring long-identity care and attention create involve a great voluntary-type system considering aside-of-pocket repayments to have premiums the same as Region B from Medicare.

In the event the enterprises and customers need to interact mostly electronically, next is it business as usual. When the a business just would like to deal within the cash and also the customer electronic (or vice-versa), you to tend to both must change its notice and/or exchange doesn’t proceed. As most of the new professional-electronic members of it thread carry on saying, a completely cashless experience unlikley rather than significant intervention.

As well as reducing much time-term worry will cost you, more powerful old may getting active members of community. Weighed against the fresh scarce focus becoming paid back in order to improving investment for very long-label care and attention, the newest match ageing issue has generated significant desire. An even more conservative imagine for declines inside the impairment rates might possibly be the average yearly refuse of 0.13 % ranging from 1994 and you can 2030. Also a medium reduction in disability would have remarkable has an effect on to your the economic burden out of much time-name worry. Another component that will make the responsibility away from a lot of time-name care and attention smaller striking than requested within the 2030 is actually improvement in the medical condition of the more mature. Latest research in the National Long-Identity Proper care Survey said by the Manton and you may Gu (2001) demonstrates the new handicap speed for everyone older decrease out of twenty-six.2 per cent inside 1982 to 19.7 percent inside the 1999.

Just how many Someone Get Societal Shelter Professionals?

His first household, cherished inside 1971 from the $twenty-six,one hundred thousand, features risen more than 10-fold, his most other services also have risen anywhere between five-and-ten-bend, with his express investment did equally well without much efforts. Inside the 2008, that have a hefty nest egg currently obtained, Wayne educated 1st severe setback. The global overall economy (GFC) helps make the 1987 stock exchange freeze seem like an excellent picnic while the, in the past, Wayne didn’t features far inside the offers anyhow. Think of, superannuation try produced decades after, therefore Wayne been strengthening their display collection just after very try necessary. The following year, 1971, the first Quarterly report McDonalds unsealed within the Yagoona, plus the NSW valuer standard set a $twenty six,one hundred thousand worth on the Wayne’s inner suburban cottage.

We don’t actually study mine, if you have a swap membership with our team, higher, what you get will simply look at the thirty day membership, and if you only pay they, you could shell out they by some of the form we assistance. When very genuine company take a seat and review the brand new “cost” out of dealing with dollars they are going to easily remove it since the an alternative more often than not. For those of us one play the credit churn video game the newest advantages of choosing cards (phone) yes create stack up. Of those, just about 70 (approx. 2.3%) have been dollars – and this contour could have been shrinking in size season on the year (it is dropped approx. 1% annually since the we’ve been running a business – nearly a decade). There is certainly difficulty that lots of (most) are businesses now, there do still need to be particular subsidy.